As we all know that STEAM is a method designed to integrate subjects into relevant education disciplines. Subjects including Science, Technology, Engineering, Art, and Mathematics. In 2013, the STEAM concept was introduced in China, gradually affecting Chinese education which was mainly occupied by the examine-oriented concept.

After 2015, China officially announced many policies benefiting the STEAM education development, being documented by the national education department. Since then, the STEAM education industry started blossoming, various start-up companies are springing up and investors were closely paying attention to it.

More and more tycoons in China are getting involved in the STEAM education industry nowadays.

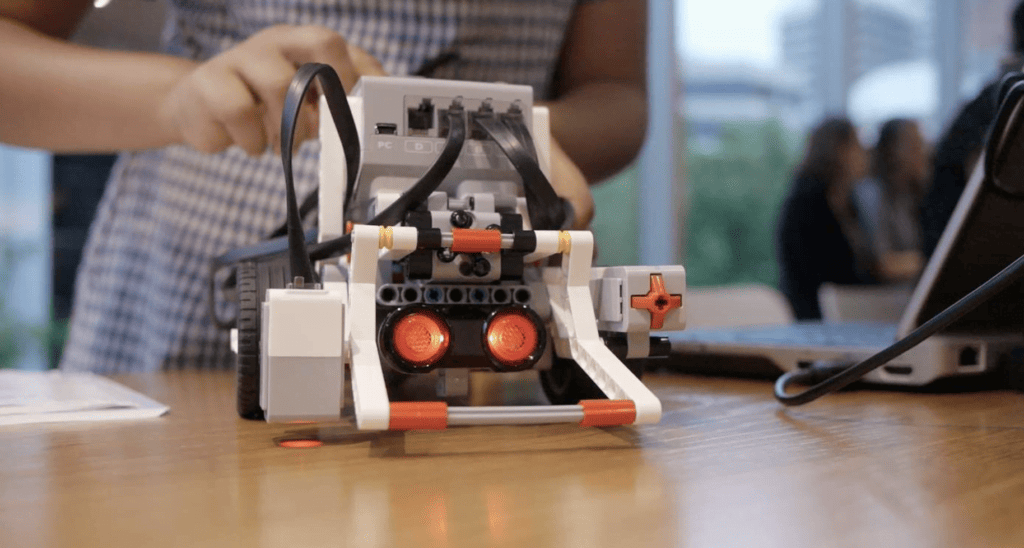

Tencent just announced the partnership with Scratch, a company providing online programming education for kids. NetEase also announced its cooperation with Lego Education in September last year for producing STEM education products and solutions.

In 2016, Xiaomi published a product called Mitu robot specifically for STEAM education. Recently, it’s reported that DJI is trying to enter this industry as well and will publish a brand new product that is focusing on STEAM education.

Main STEAM-related companies in China

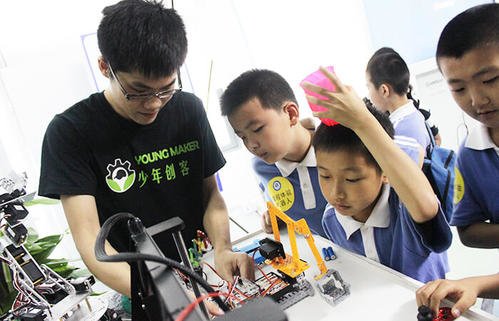

Robot education typed companies are the first ones entering the STEAM education industry in China. The main types in this area are including robot hardware suppliers and robot education institutions.

Most robot hardware suppliers are selling products in the 2B2C business model, companies like DJI, SEMIA, ROBOROBO, MRT, UBTECH, etc.; On the other hand, by buying robot products from those suppliers, the robot education institutes develop their own training course systems and franchise their businesses.

Comparatively, the children’s programming business doesn’t require too much hardware support so the business model is more simple and the marginal cost is lower, becoming the mainstream of the STEAM industry in China.

For now, most major children’s programming companies are capable of developing their exclusive coding courses and teaching methods. Their business models can be simply divided into online and offline.

The offline model is mainly focusing on the expansion of brick-and-mortar stores. Companies applying this model including TongchengTongmei (童程童美), and XiaoMa.Wang(小码王), LeapEarn ER(立乐教育), etc.

The online model is a more promising one. Because of the programming’s internet nature, it’s looked more natural for people to learn to code online. Major companies including CodeMao(编程猫), Codepku(编玩边学), VipCode, Ao meng coding(傲梦编程), etc.

The investment capital in China has also been quite active. Major investors, such as Sequoia capital, Hillhouse capital, IDG, and Sinovation Ventures, have been totally investing more than a billion CNY in those STEAM start-up companies.

However, the overall STEAM industry is still facing a great revenue challenge. With hundreds of million of investments, those major robot education companies and children’s programming companies are still just remaining in tens of million of revenue.

STEAM education is struggling in the 2B market

In around 2014, Beijing and Shanghai started trying to apply STEAM education in public schools. At the same time, China government was publishing various benefit policies to better work with STEAM education. Afterward, increasingly other cities like Shenzhen were joining.

In 2016, the government of Shenzhen city announced to build the first 100 STEAM education facilities for students and later would continue to invest 90 million CNY for building another 200 facilities in 3 years, aiming to let half of the public primary schools and high schools in Shenzhen access the STEAM education.

Seems the 2B market should be promising, right?

However, the reality is another story. Because STEAM education is still very niche and has little influence on students’ future education, most schools are being conservative and don’t want to spend too much time and money on it.

In most school, STEAM related courses are still considered electives. Those schools rather let their students pay more attention to the core curriculums like English, mathematics, and Chinese.

On the other hand, dealing with schools can be so complicated in China because most schools are showing a tough attitude and hard to work with, making companies be unable to gain much profit from their products. Also, it’s painful and time-consuming for many suppliers to build a solid relationship with public schools.

STEAM education’s demand in the 2C market is low

Unlike hardware suppliers, children’s coding companies and robot education companies are more focused on the 2C market that is requiring a stronger brand image and a higher reputation in the industry.

Robot education

Robot education is consisting of many different applied scientific areas, including mathematics science, mechanism, electric sensors, computer software, computer hardware, and artificial intelligence, aiming to inspire children’s manual dexterity, teamwork spirit, and leadership capacity. It’s reported that more than 31 percent of Chinese parents are willing to let their children take robot education.

SEMIA and ROBOROBO are the two best robot education companies in the industry, respectively selling Lego robots and Korean Roborobo robots. Since the products they’re selling are already possessing a great reputation in the market, those two companies’ annual revenues now have been up to a hundred million yuan.

According to the 2018 annual financial report of ROBOROBO, the company has opened a total of 344 online robot education institutes in 25 different provinces of China, gaining 249 million CNY in annual revenue.

However, except for SEMIA and ROBOROBO, the rest of the robot education companies in the industry are still struggling since the overall reputation of robot education is remaining developing, mostly because their brand awareness is too weak to consumers in China market, making consumers unwilling to pay for the products and services.

According to market research, more than 95 percent of robot education companies are opening less than 10 offline institutes in China, and less than 10 companies own more than 50 brick-and-mortar stores.

Children’s coding

In 2013, the invention of Scratch made the entry barrier of programming much lower. More and more children now are able to access coding so the children coding education business has been growing.

In China, the penetration rate of children’s coding education is only 1 percent but the market value is already up to 10 billion CNY, which means every 1 percent penetration rate increase will create around 10 billion market value.

People are hoping the children’s coding market can become as big as the English education market which is now estimated to have around 60 billion CNY market value in China and nurturing Unicorn companies like VIPKID.

(I’ve written an article about how Chinese learn English nowadays. It will help you know more about the English education market in China)

Unfortunately, there is still a long way to go mainly because programming education has not yet been included in the major course of the education system in China. Chinese parents don’t consider it a necessity and prefer to spend more time on other more important curriculums.

On the other hand, children’s coding concept remains unknown in many other cities of China except those in Tier 1 and Tier 2 cities. Most Chinese people don’t have the concept of learning programming at a young age.

Another critical problem is the lack of persons qualified to teach, so a unified teaching quality standard for children’s programming is still absent in the industry, making the teaching methods and quality vary greatly and people are hard to identify the good ones.

Although I said the invention of Scratch is lowering the entry barrier of programming, it’s still a difficult course for children if you compare it with English learning. No matter whether you’re learning Scratch or other high-level programming languages like Python, H5, or C++, it is requiring learners a certain level of logic capability, abstract understanding, and mathematics foundation.

What is the future of STEAM education in China?

The former Education Secretary of Finland once said: “In the future, if your children know how to code, they will be the creators of our world, or they will merely be the users.” The STEAM education industry in China is still in its early stage.

Take children’s coding education as an example

The the penetration rate in the US is up 44.8% and the UK also got a 9.31% penetration rate. But there is merely 0.96% in China. This huge gap means a great opportunity. As China keeps investing hugely in various technology areas such as AI, Automobile, programming will no longer be a professional skill but basic.

The founder of VIPCode company estimates that the children’s coding market size will become as big as one-third of the children’s English market size. He is very optimistic and believes that as AI and information technology become more and more important in China, programming skills will play a much more critical role, may being the third language of Chinese people.

What you need to understand is that STEAM education is not prevailing mainly because all STEAM-related courses are still not yet included in the mainstream examination like Gaokao (高考) which is the college entrance examination in China.

I believe the Chinese education department understands the importance of STEAM education and once the timing is mature, they will take action. If it comes true, the STEAM education industry will enjoy a super explosion.

For now, there are some signals from the government. In 2017, Zhejiang province, one of the most developed provinces in China, made general technology and information technology the elective examination in the Gaokao. By the end of 2017, Zhejiang province suggested replacing VB (Visual Basic) with Python for the information technology course, which means the Python language will be the elective examination in Gaokao.