ChatGPT has exploded in popularity at a rocket-like speed, finally rekindling excitement in the long-dormant Chinese tech and venture capital circles. Internet tycoon Wang Huiwen has invested his own funds to set up a team, while major tech companies are eager to compete and startups are not far behind.

Even some companies that have nothing to do with AI have taken advantage of the trend for marketing purposes, resulting in a surge in their stock prices.

However, only Baidu is currently set to release a product. Baidu, known for its expertise in AI technology and having invested more than 110 billion yuan in AI research and development over the past decade, naturally became the focus of attention. Like a donkey or a horse, it had to be taken out for a walk.

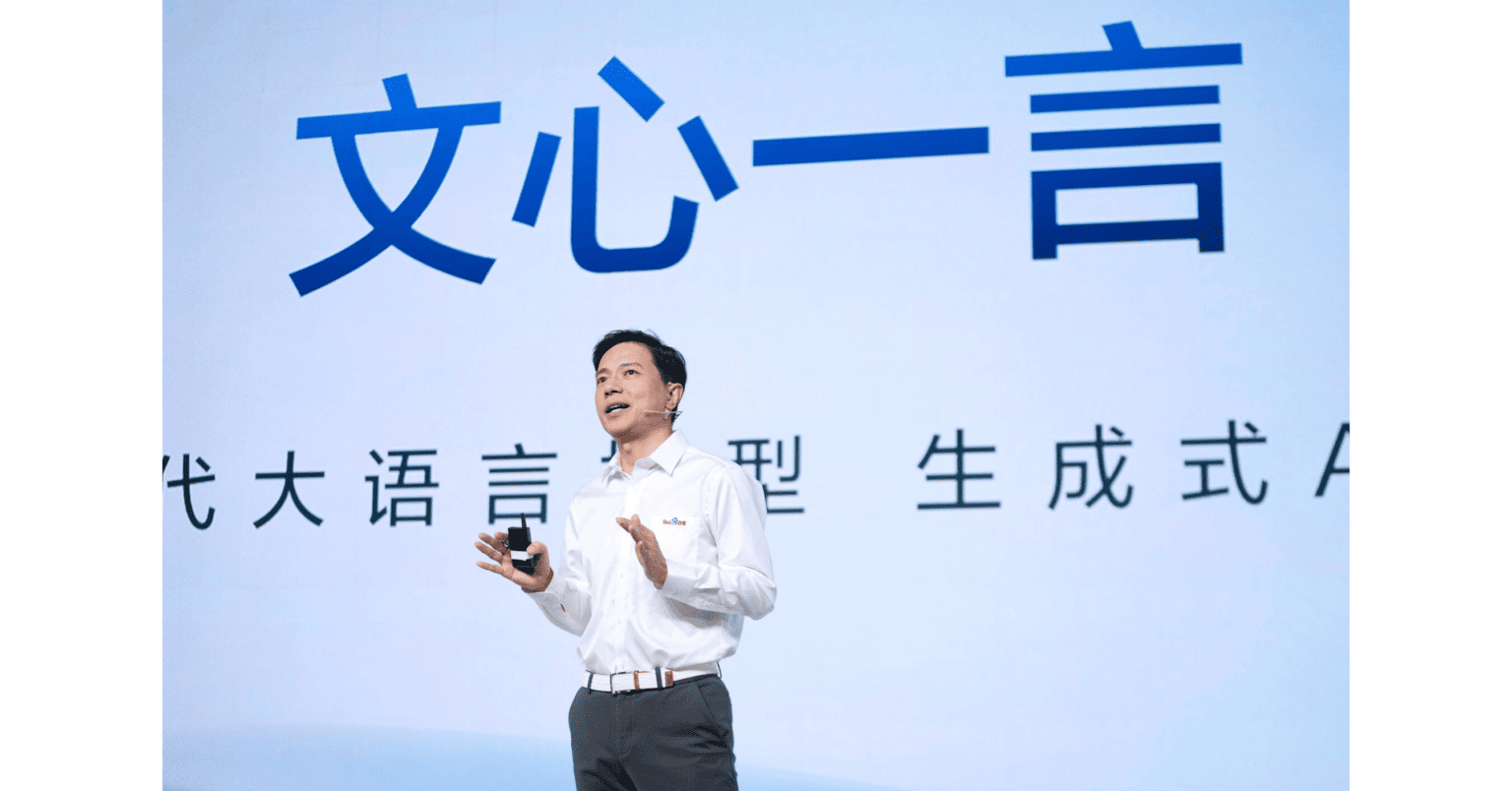

Demonstration of Baidu Ernie Bot

Coincidentally, OpenAI released GPT-4 to great fanfare on March 15th, but Baidu, which had promised to compete with ChatGPT, could not delay its release on March 16th. However, the Baidu version of ChatGPT never came, and instead, we got “ChatPPT”.

The most important part of the product launch demonstration is always the actual use of the product, as it has been since the days of Steve Jobs. Lei Jun’s “Long live Li Jie” speech still echoes in our ears. Baidu chose to record the entire launch event, which is difficult not to interpret as a lack of confidence; it may also have been scared off by the minor mishap during Google’s presentation.

At the press conference, Robin Li demonstrated the capabilities of Baidu Ernie Bot in literary creation, commercial copywriting, mathematical logic reasoning, Chinese comprehension, and multimodal generation through a pre-recorded video.

In the video, Baidu Ernie Bot helped Liu Cixin continue writing “The Three-Body Problem,” explained the economic principles behind “The Story of Lulian,” solved math problems, and generated posters and promotional videos based on instructions. However, the much-anticipated GPT-4 had already raised expectations, making Baidu’s half-finished product seem lacking, and as a result, Baidu’s stock price plummeted on the day of the press conference.

The conference seemed to have a heavy sales KPI burden, with much of the discussion focused on toB sales, abstract technical concepts, and the value of commercial cooperation. Compared to OpenAI’s focus on product, the presentation lacked appeal and effectiveness. However, based on various media trials of Baidu Ernie Bot, it is still a passable product compared to expectations.

Although there is a slight gap with Bing equipped with Chat GPT, the gap is not significant, as Baidu Ernie Bot is stronger than Bing in Chinese common sense but weaker in English content and logical reasoning. Baidu founder Robin Li seemed somewhat lacking in confidence in Baidu Ernie Bot’s performance, even lowering users’ expectations at the beginning of the conference. He stated that the threshold for benchmarking Chat GPT or even GPT-4 was still high and that there were still many imperfect areas when tested.

Baidu Ernie Bot vs. ChatGPT

Although Baidu Ernie Bot is indeed inferior to Chat GPT, it must be recognized that Chat GPT or GPT-4 is a language model that took five years and four iterations to complete the process from quantitative to qualitative change. It is almost impossible to expect Baidu Ernie Bot to surpass it in a few months.

However, having a large language model available is more important than how well it works, and once the basic framework is established, it is only a matter of time before rich language data and model calibration are stacked up to make it work well. Although many entities have claimed to be developing Chinese versions of Chat GPT, such as Tencent’s Hybrid AI and JD.com’s Chat JD, Baidu is the only one making long-term investments in AI content, making it unlikely that others will succeed if Baidu fails.

Currently, Baidu Ernie Bot is not likely to disappoint users, especially considering that Google’s highly touted Bard has not been entirely satisfactory. Based on this point, criticism of the significant difference in technological capabilities between China and the United States seems a bit excessive.

To develop a large model, the prerequisite is capital investment. OpenAI received a $1 billion investment from Microsoft in 2019 and another $10 billion this year, giving it the capital to burn. According to industry estimates, GPT-3 involves 175 billion parameters, and the training cost is about $12 million. According to a report by Guosheng Securities, training GPT-3 costs approximately $1.4 million per training.

Future of Baidu Ernie Bot

In the domestic primary market, investment institutions are anxious and uneasy in order to invest in large-scale model companies. The industry iterates with large amounts of cognition almost every day. Correspondingly, there is a wave of entrepreneurship. A group of big shots, such as Wang Huiwen, the former co-founder of Meituan, Li Zhifei, CEO of Didi Chuxing, Wang Xiaochuan, former CEO of Sogou, and Zhou Bowen, former senior vice president of JD.com, are all rushing towards the big model track.

Domestic giants are also the same. Except for Baidu, Alibaba, Tencent, Huawei, ByteDance, iFLYTEK, and SenseTime have not given up on the big model battle. The high cost of large models is not a model problem. “This is my problem,” some practitioners responded, which also shows their eagerness to make achievements in the field of large models.

For Baidu, this is a battle of life and death. Advertising is the bulk of Baidu’s revenue structure, and advertising is extremely dependent on search. If the search is overturned by GPT in the future, then Baidu will have nowhere to go.

In the full year of 2022, Baidu’s revenue and net profit both declined. In 2022, Baidu achieved revenue of 123.675 billion yuan, a year-on-year decrease of 0.66%; net profit attributable to the mother was 7.559 billion yuan, a year-on-year decrease of 23.46%.

The market share of Baidu search engine has been declining rapidly. According to research firm StatCounter, from January 2022 to January 2023, Baidu’s search engine market share has dropped from 84.36% to 65.21%. In 2022, Baidu’s advertising revenue declined year-on-year in every quarter. The data shows that Baidu’s advertising revenue in the first quarter of 2022 decreased by 3.6% year-on-year, 10% in the second quarter, 4% in the third quarter, and 5.2% in the fourth quarter. If All in AI cannot become a new growth curve, Baidu may find it difficult to maintain its status as a second-tier player.

Currently, Baidu’s advantage in developing large models is not entirely without merit. Technologically, Baidu undoubtedly has a natural advantage in the Chinese NLP field. First, its familiarity with domestic technology policies makes it more capable of meeting domestic market demand than ChatGPT. Second, as the largest Chinese search engine, Baidu has high-quality datasets and Chinese data collection capabilities that are difficult for others to match.

If Baidu Ernie Bot can be successful, domestic traffic can be reshuffled. In China, Baidu’s search traffic has been gradually diverted by other traffic monsters in the mobile internet for a long time. Today, besides Baidu’s mobile ecology, most of the big traffic portals are controlled by Tencent (WeChat, QQ), Alibaba (Alipay, Taobao), and ByteDance (TikTok); Baidu Ernie Bot has given Baidu an opportunity. If it can perform at the level of ChatGPT, it may be able to regain its traffic. Moreover, generative content will also enrich content ecology and supply, allowing Baidu’s search business to have other possibilities.

Baidu Ernie Bot is the key to Baidu’s search engine crossing from “fuzzy search” to “accurate push”. Before generative AI emerged, search engines mainly relied on “fuzzy search,” and users needed to find the content or links they needed by entering keywords in the search engine. With Baidu Ernie Bot, users can easily obtain the content or links they need through natural language interaction, and the content is more accurate, that is, “accurate push.”

At the same time, generative content will greatly enrich content ecology and supply, allowing mature search businesses and search experiences to flourish. Compared with the extensive trial and error of precision marketing in Douyin short videos, precision search like ChatGPT will undoubtedly reduce a lot of costs, which is very attractive to advertisers. Of course, Baidu still needs to figure out how to deliver truly valuable information to users, not just advertising information, to avoid the embarrassment of the current search engine advertising business.

There is another important point. The emergence of Baidu Ernie Bot will accelerate Baidu’s empowerment of other industries through artificial intelligence technology. From a technological perspective, based on Baidu Baidu Ernie Bot’s large model, multiple single-point products targeting the consumer market have already been developed, such as the industry-level search system “Wenxin Baizhong”.

In conclusion

An investor said that to make Chat GPT in China, there are three major obstacles to overcome. First is the mountain of funding. Microsoft has invested a total of $10 billion in recent years, so for China to start, it would require at least $1 billion, which is not particularly difficult for large domestic companies. Second is the problem of tool restrictions and chip sales bans. Running AI models requires a large number of GPU chips, but being limited by chip availability has affected the ability to develop AI models. To run a model with a parameter quantity of over 100 billion, at least “1,000 kilowatts per month” is required, which means using 1,000 GPU cards and training for a month.

Even if the most advanced NVIDIA A100 is not used, with an average price of 50,000 yuan per GPU, 1,000 GPUs would mean a monthly computing cost of 50 million yuan, not including the salary of algorithm engineers. It is not clear how Baidu has solved this problem at present. Third is the shortage of AI talent, especially in the field of NLP, which is still very scarce in China. With the different world situation and domestic financial prospects now, how to “systematically attract talent to return to China” has become a huge challenge. Domestic companies need to use more creativity to attract talent instead of just raising salaries.

Therefore, one must think carefully before embarking on making large models such as Chat GPT. Don’t become cannon fodder like the metaverse after the trend has passed. Compared to most companies focusing on language applications for GPT, Ren Zhengfei is more focused on promoting industrial and agricultural societies, believing that 98% of the opportunities lie in these areas. What are the opportunities for us with Chat GPT? It will expand computing and pipeline flow, creating a market demand for our products.

Ren Zhengfei’s words still have some truth. Industrial demand for AI is still easily realized with strong demand and visible efficiency improvements. The era of change has come, and innovation is no longer optional but necessary.

FAQ: About Baidu Ernie Bot

Baidu has put its leading AI capabilities into our products and services, as well as innovative use cases. Over the past two decades, it has built a diversified portfolio of products and services with large total market opportunities.

The artificial intelligence (AI) industry in China is a rapidly developing multi-billion dollar industry. As of 2021, the artificial intelligence market is worth about RMB 150 billion (US$23.196 billion), and is projected to reach RMB 400 billion (US$61.855 billion) by 2025.

Amidst the pandemic, Baidu has taken the initiative to open-source several AI platforms. Notably, the company has released software that can detect whether someone is wearing a mask.